Unpacking Cordx Net Worth: What Shapes A Global Biotech Company's Value Today

What makes a company truly valuable? Is it just the numbers on a spreadsheet, or something deeper, something that shows its real impact? For many, understanding a company's worth goes beyond simple figures, looking at its overall health and its place in the market, in a way.

For a company like Cordx, a name many might recognize in the healthcare world, figuring out its financial standing, its net worth, can seem like a bit of a puzzle. This is especially true for private organizations, where financial details aren't always shared widely, you know.

We'll explore what gives a company like Cordx its financial muscle, looking at the things that really count for a biotechnology organization that works across the globe, too it's almost. We'll talk about the pieces that come together to form its overall value, giving us a clearer picture, pretty much.

- David Bromstad Net Worth

- Deephotlink

- Jackerman Mothers Warmth 3 Release Date

- Video Viral Mayeng003 Portal Zacarias The Talks

Table of Contents

- What is a Company's Net Worth?

- Cordx: A Global Force in Biotechnology

- Key Elements That Shape Cordx's Financial Standing

- Understanding the Value of Biotech Operations

- Frequently Asked Questions About Cordx

- Looking Ahead: The Future of Cordx's Value

What is a Company's Net Worth?

When we talk about a company's net worth, we're essentially talking about its value. It's the total value of all its assets minus all its liabilities. Think of it like this: what the company owns (buildings, cash, patents, equipment) minus what it owes (debts, loans). The result gives you a general idea of what the company is worth on paper, so.

For a business, especially one that isn't publicly traded on a stock exchange, figuring out this number can be a complex task. It's not just about physical things; it also includes intangible assets, like brand reputation, intellectual property, and even the skills of its people. These things don't have a clear price tag, but they add a lot of worth, you know.

The net worth of a company can change quite a bit over time, reflecting its financial performance, market conditions, and how well it's managing its resources. It's a snapshot, really, of its financial health at a particular moment, basically.

- Nude Photos Of Brandi From Storage Wars

- Breckie Hill Leaked Only Fans

- Vintage Family Nudist

- Sydney Sweeney Naked

- Mario Kart 8 Deluxe Rom

Cordx: A Global Force in Biotechnology

Cordx is, as a matter of fact, a biotechnology organization that works hard to deliver medical device solutions. These solutions go to healthcare industries all around the world, helping over a billion users in more than 170 countries. That's a huge reach, pretty much, showing its wide influence.

A Focus on Diagnostics

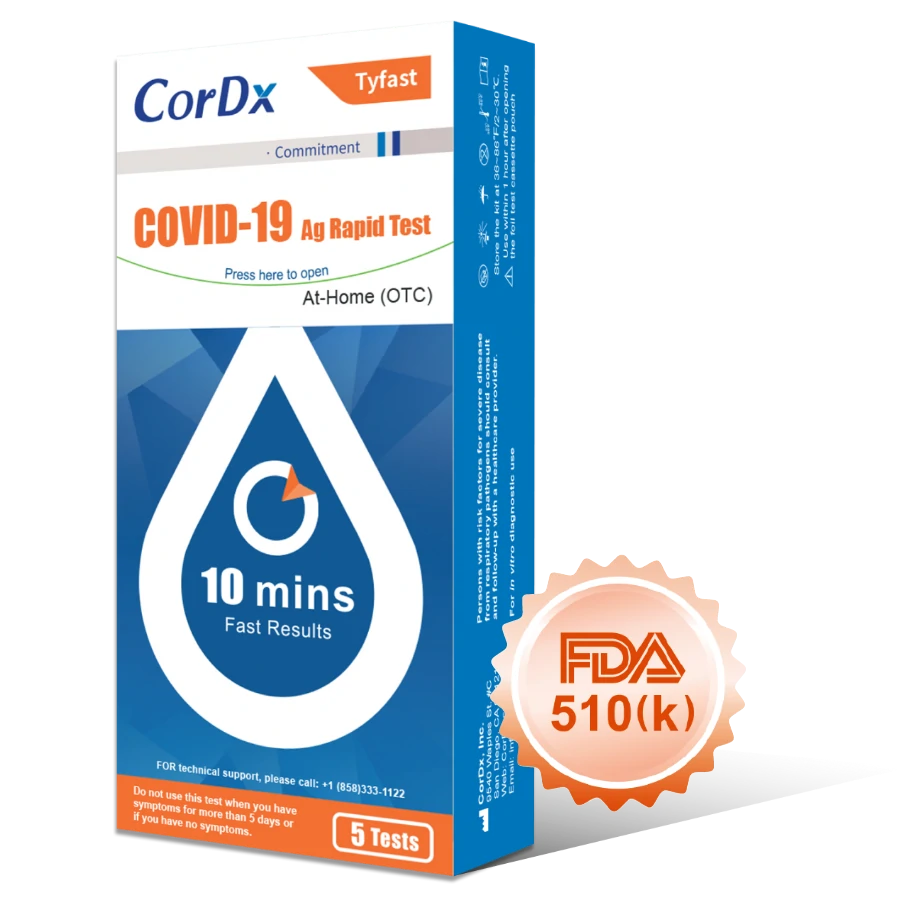

A big part of what Cordx does centers on diagnostics. They provide tests that give reliable results in just 10 minutes. This speed and comfort, combined with accuracy, make their tests quite notable in the medical field. These tests are, in fact, recognized for their quality, allowing quick and dependable health assessments.

Their diagnostic tests have also received important approvals. They have authorization for use in the US from the FDA, in Europe with the CE Mark, and in China from the NMPA. These authorizations mean their products meet high standards and can be trusted by healthcare providers and patients alike, you know.

Cordx is deeply committed to providing diagnostic products of the highest quality for caregivers, for families, and for you. This commitment to excellence is a core part of their operations, ensuring that the products they put out are dependable, absolutely.

Global Reach and Impact

The company's presence in over 170 countries means its medical device solutions touch many lives. This wide distribution helps healthcare industries provide better care to a vast number of people. It shows a significant footprint on the global health scene, in a way.

Helping over a billion users is a testament to the scale of their operations and the widespread need for their products. This kind of broad user base suggests a strong demand for their diagnostic tools and medical devices, naturally.

Innovation and Supply Chain Control

Cordx, as a global biotechnology organization, is working to change the global diagnostics industry. They do this with new research and development solutions. This focus on innovation helps them create better ways to test and diagnose, always looking for improvements, so.

They also have what's called a vertically integrated supply chain. This means they control many steps of their production process, from start to finish. They even have manufacturing facilities in various places, which helps them manage their production effectively, quite honestly.

It's interesting to note that Cordx is one of the only manufacturers in the world that owns its own IVD (In Vitro Diagnostic) manufacturing supply chain. This level of control is pretty unique and gives them a lot of say over the quality and availability of their products, you know.

They ask people to rely on Cordx to get the POC (Point-of-Care) tests they need. This suggests a direct and important role in providing quick, on-the-spot diagnostic tools that are vital for immediate health assessments, in some respects.

Key Elements That Shape Cordx's Financial Standing

When we think about the net worth of a company like Cordx, it's not just about how much money they have in the bank. It's about a whole range of things that contribute to its overall value and potential. These elements paint a picture of its financial strength, pretty much.

Market Position and Global Presence

Cordx's standing as a biotechnology organization delivering medical device solutions to healthcare industries is quite strong. Being active in over 170 countries and serving over a billion users gives them a very wide market reach, which is a big asset. This global presence means they have many potential customers and can spread their financial risks across different regions, you know.

A company with such extensive international operations can often achieve economies of scale, meaning they can produce things more cheaply per unit as they make more of them. This can lead to better profit margins and, by extension, contribute positively to their overall financial health and worth, naturally.

Their widespread use also helps build a strong brand name and reputation across different cultures and healthcare systems. A good reputation can attract more business and talent, which are both valuable assets for any company, so.

Product Innovation and Regulatory Success

The fact that Cordx offers reliable diagnostics in just 10 minutes is a significant advantage. Speed and accuracy in medical testing are highly valued, especially in fast-paced healthcare settings. This kind of product innovation can lead to high demand and steady revenue streams, which directly impact a company's financial performance, basically.

Having authorizations for use in the US (FDA), Europe (CE Mark), and China (NMPA) is incredibly important for a medical device company. These approvals show that their products meet strict safety and effectiveness standards in major global markets. Without these, they couldn't sell their products in these places, so getting them is a huge step for market access and credibility, you know.

These regulatory successes mean Cordx can operate in highly regulated and profitable markets, giving them a competitive edge. It also suggests that their research and development efforts are effective and can produce products that pass rigorous scrutiny, which is a sign of good internal processes, too it's almost.

Integrated Supply Chain Benefits

Cordx's choice to own its own IVD manufacturing supply chain is a distinct feature. This vertical integration means they control more of the process, from getting raw materials to making the final product. This can lead to several financial benefits, like better cost control, as they might not have to pay markups to outside suppliers, pretty much.

Controlling their supply chain also helps them ensure the quality of their products from start to finish. This consistent quality can build customer trust and reduce the likelihood of costly recalls or quality issues down the line. It also means they can respond more quickly to changes in demand or supply, giving them more flexibility in their operations, you know.

In times when global supply chains face disruptions, owning their own manufacturing can be a big advantage. It provides a level of resilience and independence that can protect their production and sales, which in turn safeguards their financial stability and value, in a way.

Commitment to Quality and Trust

Cordx's commitment to providing diagnostic products of the highest caliber of quality for caregivers, for families, and for you, speaks to its brand reputation. In the healthcare industry, trust and reliability are paramount. A company known for high quality can command better prices, maintain customer loyalty, and attract new business, which all help its financial standing, so.

This focus on quality can also reduce warranty claims and customer service issues, saving the company money in the long run. It builds a positive image that makes it a preferred choice for healthcare providers, contributing to steady revenue and growth, you know.

Understanding the Value of Biotech Operations

The value of a biotechnology company like Cordx is often tied to its intellectual property, its pipeline of new products, and its ability to bring those products to market. For Cordx, their innovative R&D solutions are a key part of their potential value. Investing in research means they are building for the future, creating new solutions that could become major revenue generators, naturally.

The diagnostic industry itself is a growing field, with an increasing demand for quick, accurate, and accessible tests. Cordx's position within this industry, with its global reach and established products, places it in a good spot to benefit from these trends. The ability to meet a widespread need for point-of-care tests is a significant driver of value, very much.

While specific financial figures for Cordx's net worth are not publicly available from the provided information, we can see that the company possesses many characteristics that contribute to a strong valuation. These include a wide global footprint, crucial regulatory approvals, a focus on innovation, and control over its manufacturing process. These are the kinds of things that investors and financial analysts would look at when trying to put a value on a company like this, pretty much.

A company's overall worth is a dynamic thing, always changing with market conditions, new developments, and its own operational success. For Cordx, its continued work in transforming the global diagnostics industry through its innovative approaches and integrated supply chain will certainly play a big part in its ongoing financial story, you know.

For more general information on the economic trends shaping the biotechnology sector, you might find it helpful to look at reports from financial institutions or industry groups. You can learn more about biotechnology industry trends to see the broader context in which companies like Cordx operate, so.

Frequently Asked Questions About Cordx

People often have questions about companies, especially those that play a big part in our health. Here are a few common thoughts people might have about Cordx:

Is Cordx a publicly traded company?

Based on the information provided, there's no mention of Cordx being listed on a stock exchange. Companies that are not publicly traded typically do not disclose their detailed financial statements, including their net worth, to the general public. This is a common practice for private companies, you know.

What kind of impact does Cordx have on global healthcare?

Cordx delivers medical device solutions to healthcare industries and reaches over a billion users in more than 170 countries. This suggests a very significant impact on global health, particularly through its reliable and fast diagnostic tests. Their products are used widely, helping many people get quick health information, pretty much.

Why is owning its own manufacturing supply chain important for Cordx?

Owning its own IVD manufacturing supply chain means Cordx has greater control over the quality, cost, and availability of its products. This can lead to more consistent product quality, better cost management, and the ability to respond more quickly to market needs or supply chain challenges. It's a strategic move that helps secure its operations, in a way. You can learn more about Cordx on our site, and discover our journey by visiting this page.

Looking Ahead: The Future of Cordx's Value

The future value of Cordx will likely depend on its continued ability to innovate, expand its reach, and maintain its high standards of quality. As the global demand for quick and accurate diagnostics keeps growing, Cordx's established presence and its unique control over its supply chain position it well for ongoing success. Its ongoing research and development efforts, for instance, are key to staying competitive and creating new products that will meet future healthcare needs, you know.

The company's commitment to providing top-quality diagnostic products for caregivers, families, and individuals also builds long-term trust and loyalty. This kind of reputation is an intangible asset that can contribute significantly to a company's overall worth over time. It's about building lasting relationships and providing dependable solutions, too it's almost.

Monitoring market trends in biotechnology and medical devices, along with global health initiatives, would give further clues about the path Cordx might take. Its ability to adapt to new regulations, technological advancements, and shifting healthcare demands will also play a big part in shaping its financial story going forward, very much.

- Jackerman Mothers Warmth 3 Release Date

- Tim Scott First Wife

- David Bromstad Net Worth

- Link Somali Telegram 2025

- Jasmine Crockett Husband And Children

NanoEngineering Department at UC San Diego Receives $2.1M Gift from the Aiiso Yufeng Li Family

$3 Million Gift from CorDx to Boost Sustainable Energy Innovation at UC San Diego

CorDx